tax credit survey mean

This tax credit may give the employer the incentive to hire you for the job. A company hiring these seasonal workers receives a tax credit of 1200 per worker.

Families Are Struggling Financially Without Monthly Child Tax Credit

If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600.

. A tax credit is an amount of money given to a taxpayer by the IRS that reduces their tax bill on a dollar-for-dollar basis. A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly. A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have.

Online taxpayercustomer experience survey IRSgov Ongoing. In Australia any kind of task you perform through online platforms. Types of Tax Credits.

So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. Parcels outside of town it is more common. A tax credit is an amount of money that taxpayers are permitted to subtract from taxes owed to their government.

In general how online surveys taxes are calculated or not depends a lot on your country. We request that you complete the following survey to determine if our company may be eligible for tax credits based on our hiring practices. I dont just give anyone my SSN unless I am hired for a job or for credit.

After submitting your application you will be asked to complete the WOTC. The Child and Dependent Care Credit. Land survey if they do one would be listed in the closing document as an expense.

You can possibly claim a credit equally to 26 percent of an employee. The value of a tax credit depends on the nature of the credit. Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC.

The Child and Dependent Care Credit effectively reimburses you for some of what you must pay to a care provider to watch your children or your disabled dependents while you work or look for work. I also thought that asking for a persons age was discriminatory. For example if youre the 22 tax bracket and you have a 100 deduction that deduction will save you 22 in taxes 22 of 100.

However if you have a 100 tax credit it will save you 100 in taxes. When you have a refundable tax credit like the Earned Income Tax Credit you receive part of the credit as a tax refund if it reduces your tax bill to a negative number. It is not done on all sales as the lots are generally plotted already and there is no need for it most of the time.

Chief Executive of charity Turn2us commented Todays vote in the House of Commons will mean one thing for many of the poorest working. If you have any technical issues while completing the survey you can easily return to the Tax Credit Check page and re-initiate the survey at any point. Knowledgeable enough or properly equipped to file for credits or to file for them effectively enough to maximize whats available to them.

Research Applied Analytics and Statistics RAAS Individual Taxpayer Burden Survey ITB 7312020 2018 Study Mail Online. For the 2021 tax year the credit was temporarily expanded to up to 8000 in costs for two or more children or 4000 if. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment.

Tax credit questions become part of the application and applicants view the extra 30 seconds to two minutes that are required to complete the hiring incentive questions as just another step in. Of the government-funded hiring incentives the one with the highest visibility is Work. It is one of the last steps in.

The Work Opportunity Tax Credit WOTC can help you get a job. It asks for your SSN and if you are under 40. Answer the questions and provide your e-signature.

Generally tax credits can be refundable or nonrefundable. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar. In the US it is for example considered as taxable income if you have earned more than 600 in a tax year from online surveys no matter if you have been paid in gift cards or cash.

This is the Ernst Youngs vendor survey site. EMPLOYER WILL NOT SEE YOUR RESPONSES. Tax Pro Account Survey.

Thats what tax pros mean when they say tax credits are a. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. This tax credit is for a period of six months but it can be for up to 40.

A survey by End Child Poverty estimated that roughly 15 million parents have reduced. Deductions reduce your taxable income while credits lower your tax liability. The WOTC survey displays in the current browser window.

Opportunity Tax Credit WOTC the flagship federal program jointly managed by the IRS and Department of Labor. In other words if you receive a 1000 refundable tax credit but your tax bill is only 500. Pre-Hire During the Application Process If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process.

These are the target groups of job seekers who can qualify an.

What Is A Property Survey And Why Is It Important

2022 Everything You Need To Know About Car Allowances

College Students In The News Education Daily Journal Online Financial Advice Personal Finance Finance

Climate Action Incentive Payments Caip For 2022 How Much Will You Get Savvy New Canadians

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Ccb Understanding The Canada Child Benefit Notice Canada Ca

Closing Costs That Are And Aren T Tax Deductible Lendingtree

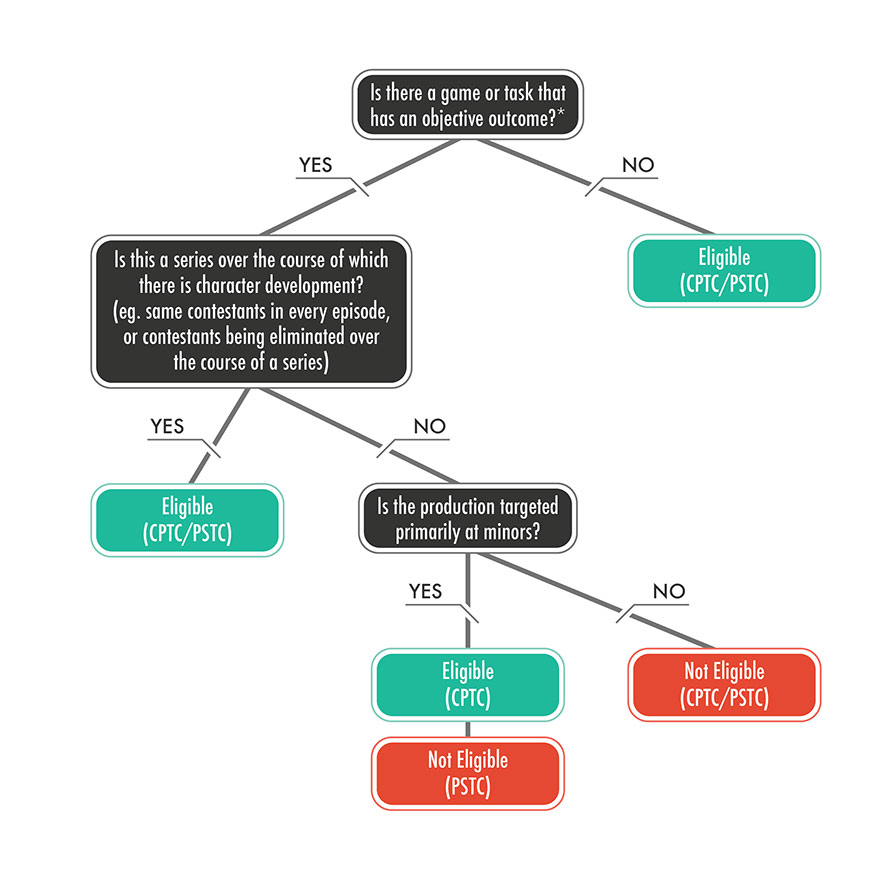

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Families Are Struggling Financially Without Monthly Child Tax Credit

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Digital News Subscription Tax Credit In Canada What You Need To Know Savvy New Canadians

Digital News Subscription Tax Credit In Canada What You Need To Know Savvy New Canadians